Global Top 50 Law Firm Brands 2019

HIGHLIGHTS

- Kirkland & Ellis maintains position as the most valuable global law firm brand.

- White & Case and Debevoise biggest risers in top 40 places.

- UK firms steady but in the doldrums compared to fastest-growing US firms.

- Arnold & Porter biggest riser in top 50 places.

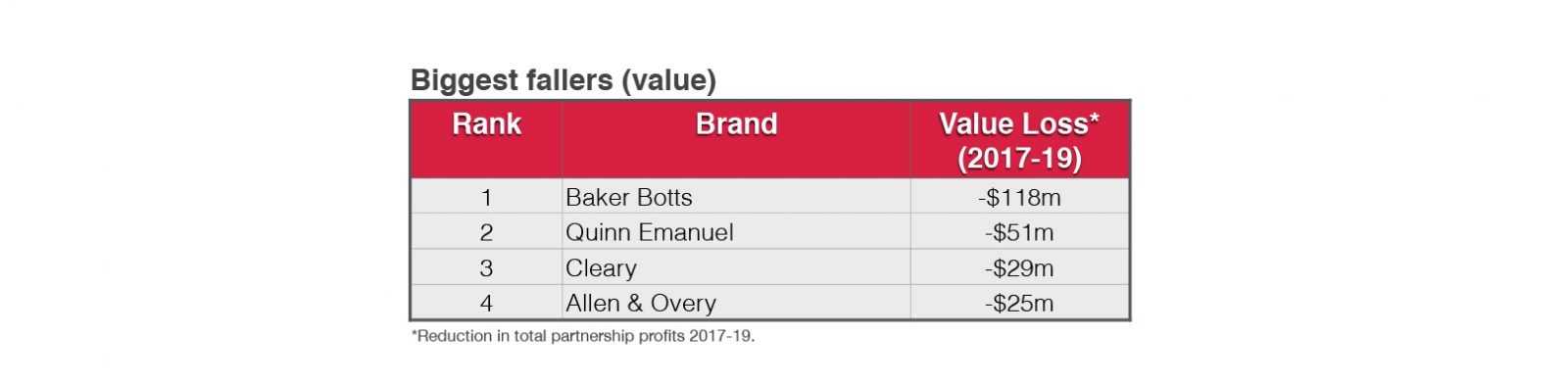

- Baker Botts biggest faller in top 50 places and brand value.

- 18 firms (all US-headquartered) grow brand value by more than $100m.

- Average global top 50 place gain worth $38m per annum to firm.

Kirkland and Latham have maintained their positions this year as the world’s most valuable global law firm brands closely followed by Skadden (see table).

The top six firms have remained in precisely the same relative positions over the last two years (2017-19), while the rest of the top 20 has seen more movement.

Kirkland and Latham are the world’s most valuable law firm brands closely followed by Skadden.

Following on from the UK-headquartered firms publishing their 2018/19 results over the summer months we can now add these to those already published by the US-headquartered firms to reveal the 2019 Global Top 50 law firm brand rankings*.

*Ranking the 50 most prestigious global firms by their ‘global partnership profits’ gives a rigorous and substantive basis for assessing their relative brand strengths (see ‘the one number to watch’ below).

This year’s results also highlight Kirkland’s phenomenal growth, even relative to its peers. The firm’s brand has grown in value between 2017 and 2019 by as much as the rest of the top five firms combined ($694m vs $612m). Despite its size, Kirkland is also the highest relative growth firm in the top 50 – growing in brand value by 47% in two years.

Another way to represent the scale of this performance is to consider that Kirkland has added the value of two whole Slaughter & Mays – to its brand in just two years.

Latham & Watkins would be the star of the show if it weren’t for Kirkland, having gained $261m over the two years, making it comfortably the second biggest gainer in the Global Top 50 and, like Kirkland, pulling away from the pack of following firms.

On average, each place gain in the top 50 rankings is worth $38m per annum in additional overall profits to the firm.

White & Case and Debevoise are the biggest risers in top 40 places (each rising seven places, 37% and 34% increases in brand value respectively – and, it pleases me considerably to say given the total data-driven objectivity of this analysis, that both firms are former clients).

Arnold & Porter is the biggest riser overall in the Global Top 50 in terms of places – rising 11 places from 50 to 39 – with a substantial increase of $114m which comes a close second to Kirkland in terms of relative growth at 43%.

Baker Botts has suffered the biggest fall in relative brand value of all the Global Top 50 firms, falling 16 places overall and losing $118m in value. The firm has noted that snapshot annual figures miss the contingency nature of their revenues and anticipate making up ground lost to other firms in the coming years. The other two firms that suffered falls in place rankings are Cleary (falling six places) and Atkin Gump (falling five places).

The six UK-headquartered firms that feature in the Global Top 50 (the four Magic Circle firms: Linklaters, Clifford Chance, Allen & Overy, and Freshfields plus Herbert Smith and Slaughter & May) have just about maintained their positions in the rankings over the two year period and perhaps, if Brexit hadn’t so negatively impacted the pound to dollar rate, might even have gained a couple of places. Three UK firms (Linklaters, Allen & Overy and Freshfields) maintain their top 10 global brand rankings. However, they will be aware that, in terms of global brand momentum, Kirkland and Latham appear to be rocket-propelled, by comparison, raising the heat on their need to somehow break into the US in a more substantial way the near future to avoid losing brand strength compared to the rapidly expanding US firms.

Another substantial finding from these results is that 18 firms in the Global Top 50 added more than $100m to their total partnership profits (and hence their relative brand value) across the two years (all US-headquartered firms), indicating that the field is still highly competitive and that many firms are moving forward in strides. It will be interesting to see if this broad sharing of gains is sustained in the coming years or whether the increases become concentrated among a smaller group of firms.

On average, each place gain in the Global Top 50 rankings is worth $38m per annum in additional overall profits to the firm. This figure demonstrates the enormous potential commercial benefits available to those firms that can develop strategies to enhance their global brand reputation, relevance, and visibility in the market. The seven place gains made by White & Case and Debevoise, for example, have netted those firms an additional $207m and $121m respectively in annual distributable profits.

These three components added together comprise a firm’s ‘brand,’ arguably the only source of sustainable competitive advantage that a law firm has.

—

The one number to watch – why total partnership profits are a good measure of relative brand strength in Big Law.

The key to this insight lies in the underlying dynamics of the global law firm market which although quirky in many ways is, in economic-theory terms, a reasonably frictionless or ‘pure’ market (lots of competitors with relatively low market share, low barriers to entry/exit, similar products and excellent price visibility).

In other sectors profits can be heavily influenced by ownership of critical IP (pharma), regulations and licences that thwart competition (telecoms), assets that bar entry (energy), effective monopolies or oligopolies (big tech), etc. none of which applies in any significant way in the premium legal market.

Firms only succeed commercially over time if they compete effectively year in year out for what they earn and because the purchase cycle is relatively short clients can react quickly to any perceived changes in the relative competitiveness of any one firm.

Being a relatively ‘pure’ market, individual firms (and their partners) compete based on 3 components: reputation (what those who’ve experienced you think about your service), relevance (what problems you’re perceived to be best at solving and where geographically you solve them) and visibility (how well known you’re known to the clients around the world who have those problems – and the budgets to pay for your services).

These three components added together comprise a firm’s ‘brand’ – the combined brand equity of the firm and the partners within it (who also have brands of their own) – arguably the only source of sustainable competitive advantage that a law firm has.

It’s useful to point out that being a ‘stronger’ and more valuable brand overall does not necessarily imply being a ‘better’ brand for every occasion. For instance, the Mercedes brand is regularly measured to be approx. 10 times as valuable as the Ferrari brand in surveys ($50bn vs. $5bn).

—

PATH TO GROWTH?

The results of this analysis of the 2019 Global Top 50 law firm brands provide an opportunity to reflect on the strategic brand strategies open to firms wishing to succeed in an increasingly competitive global market.

Staying super-focused on existing markets and clients and fending off competition for premium work is hard, as is entering new markets and building a reputation for quality there. Doing both simultaneously is exponentially more challenging, and without a strong brand impossible.

As law firm leadership teams know only too well, profitable, non-dilutive growth is highly elusive, and the market forces at work can appear to be contradictory, making alignment on market messages and internal partnership engagement complex.

On the one hand, communicating a message to partners and teams around raising profitability through a focus on doing more of what you already do best, billable hours, efficiency, etc. On the other hand, communicating the need to make targeted investments for future growth, which inevitably means doing things you don’t do as well, in places you’re less well known and for clients who may not know you very well, if at all. This means investing heavily in non-billable marketing and business development activities (including bringing in laterals).

Hats off to those leadership teams that manage to navigate and communicate that lot in simple, coherent terms to a bunch of independent-minded partners spread around the world! Despite the challenge, some leading firms are managing to do both and build stronger global brands as they do it – these are the firms leading the rankings.

A CLOSER LOOK

Digging into the rankings a bit deeper there are some interesting observations:

In terms of strategy, three models appear to be the most successful:

Brands that can sustain 100-150 partners working on premium work, mainly from New York.

Brands that can sustain between 300 and 400 partners focused on premium work from a larger group of commercial centres (including at least one of New York or London and increasingly both).

Brands with closer to 1000 partners, more geographically spread but making a good average PEP.

Right now, the most successful brands are in the 3-400 partners group but with three 1000-types (Jones Day, Morgan Lewis and Baker McKenzie) holding their own in this company.

WHAT NEXT?

What does this analysis imply in terms of the questions leadership teams should ask themselves about the role of brand in future growth strategy?

What brand strategy will most effectively help us grow our ‘overall distributable profits’?

Can we trade up by targeting a more premium level of work that generates higher PPP? What will it take to achieve this, what are our sources of competitive advantage, and how do we market this effectively?

Can we build out by expanding our brand to be more relevant to more clients? What will it take to achieve this, what are our sources of competitive advantage, and how do we market this effectively?

Can/must we do both at the same time?

If you enjoyed this article please like and share with others. If you want to recieve more like this from Principia you can subscribe here (bottom of page).