Brand Power and Profitability: Principia's Top 40 Law Firm Brand Index (US-HQ)

A Market No Longer in Suspension

In a profession often perceived as slow to change, recent years have quietly ushered in a significant transformation in the brand dynamics of US-headquartered Big Law firms.

While year-to-year shifts in prestige and profitability may seem incremental, the cumulative impact from 2019 to 2024 reveals an unmistakable pattern: the strongest brands are pulling away, converting perception into pricing power, scale into visibility, and strategy into market dominance.

Once fragmented and regionally bound, the global legal services market is fast maturing into a more consolidated, transparent, and competitive arena.

And the firms that have treated brand not as surface-level identity, but as deep strategic infrastructure are now reaping disproportionate rewards.

Brand is not merely a differentiator; it is the engine of long-term profitability.

Brand is Strategy Made Visible

At its core, brand strength in Big Law is not a matter of logos or aesthetics. It is the outward expression of a firm’s internal coherence—a function of reputation, relevance, and visibility.

In commercial terms, this translates into sustained pricing power, competitive resilience, and the ability to command premium work on a global scale. Read more on the distinction between strategic and surface branding in Big B Brand vs Little b Brand.

Unlike many sectors shielded by IP protections, regulatory moats, or monopolistic structures, the legal market remains relatively frictionless. Firms must earn their margins anew each year.

In such a market, brand is not merely a differentiator; it is the engine of long-term profitability.

Brand equity in Big Law does not leap; it accrues.

The Ascent of the Global Elite

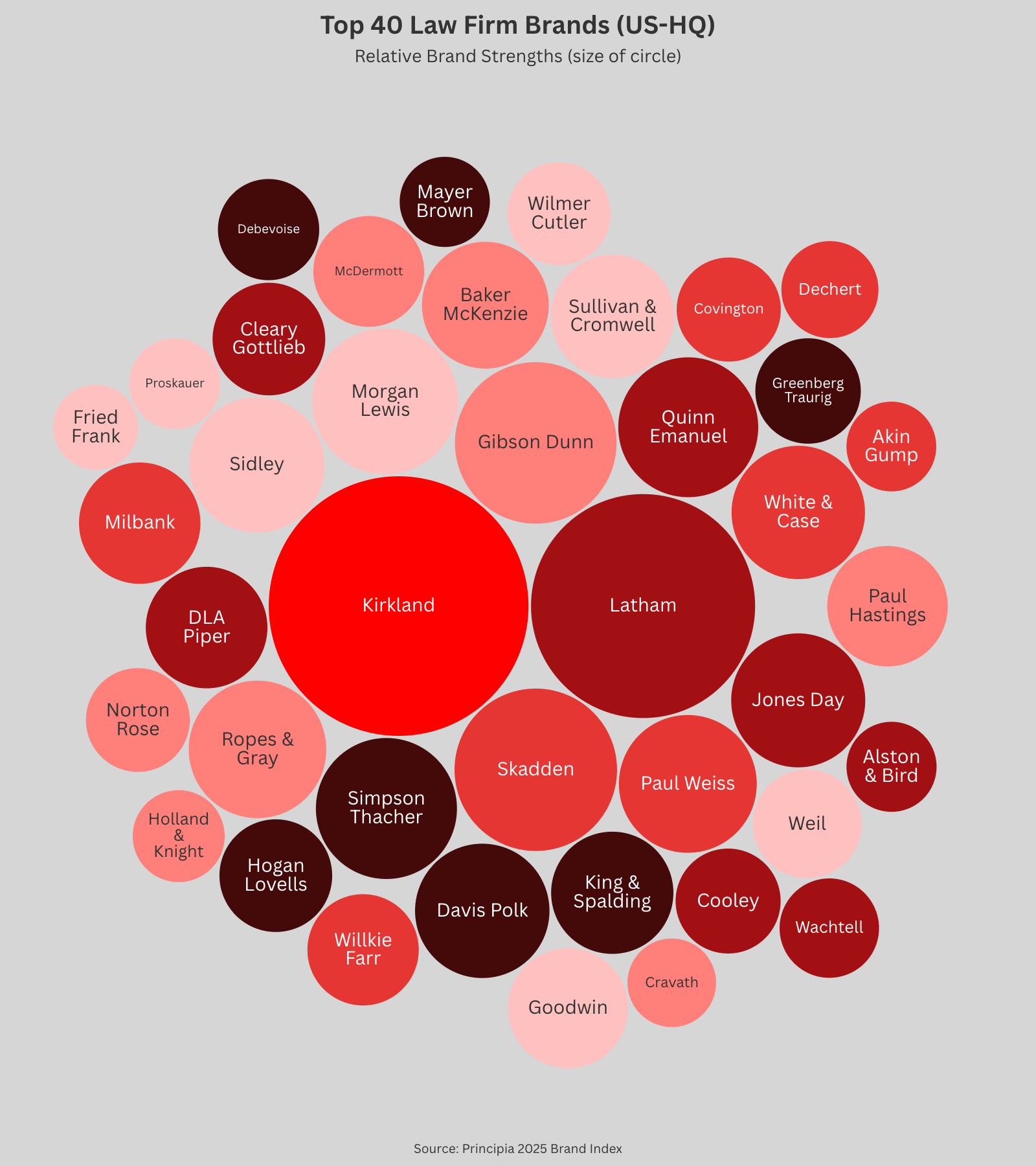

A global elite is forming with unmistakable momentum.

Kirkland & Ellis, not so long ago a regional firm, now dominates the field—not only retaining the top position in profitability but expanding its lead dramatically, increasing total partnership profit by over $2.9 billion in five years.

Latham & Watkins follows closely, adding more than $2 billion in profit.

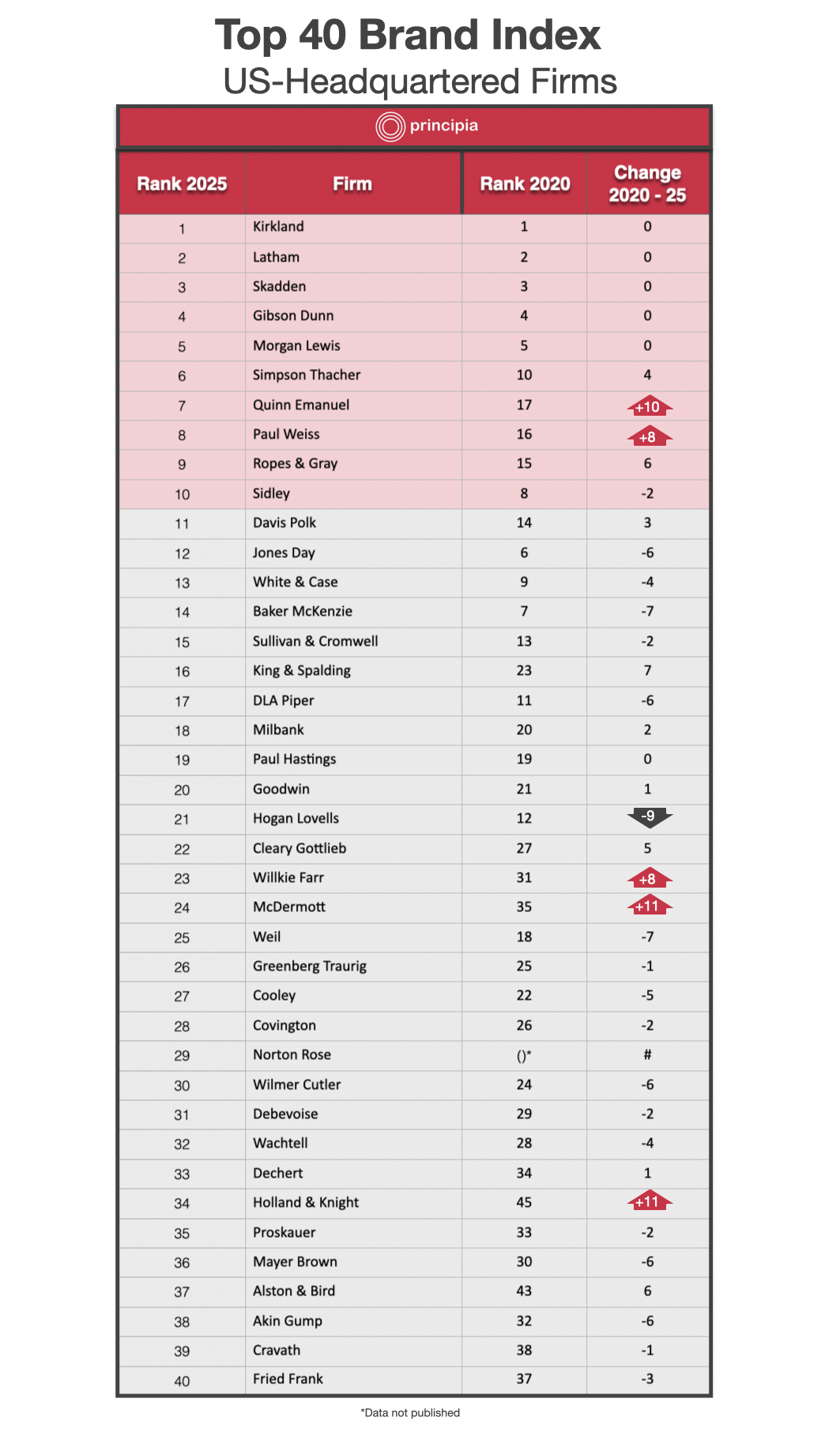

Quinn Emanuel and Paul Weiss have surged 10 and 8 places respectively in the rankings, driven by their strategic focus on litigation and private equity.

Ropes & Gray has broken into the top 10; no mean feat given the strength of the firms at the top of the rankings and the relative profitability increases required to move up the rankings.

McDermott is another standout, jumping 11 places—along with Holland & Knight, the largest upward move among all firms in the 2024 Brand Index. Willkie Farr, a step higher, has also advanced significantly.

King & Spalding has strengthened its brand stature through disciplined international expansion and practice focus.

Holland & Knight continues to add brand strength, entering the top 40 and advancing 11 places.

(see ‘methodology sidebar’ below for information on our brand ranking analysis).

Incremental Growth, Exponential Outcomes

Incremental Growth, Exponential Outcomes

These success stories share a common thread: incremental improvements, compounded over time.

Brand equity in Big Law does not leap; it accrues. A few additional premium mandates each year, a modest uplift in pricing integrity, or a new international office with reputational traction can snowball into transformational outcomes.

As explored in our article Brand: The Key to 50% Profitability, this type of cumulative investment is what enables firms to reach and sustain sector-leading margins.

A global elite is forming with unmistakable momentum.

A Five-Year Inflection Point: Convergence or Chasm?

As we move through the 2020s, the legal sector may finally see the kind of structural brand convergence observed in accounting and consulting.

Will a clearly defined global top ten emerge, or will the market sustain a longer tail of strong, differentiated players?

One thing is clear: for firms aspiring to stay relevant, brand must be treated not as a communications function but as a strategic asset—tracked, invested in, and managed with the same rigour as profitability. See: Why the Most Profitable Firms Have the Strongest Brands.

Methodology Sidebar: Why Total Partnership Profits Are a Proxy for Brand Strength

Our methodology ranks the most prestigious US-headquartered firms by their ‘global partnership profits’, providing a rigorous and substantive basis for assessing relative brand value and strength over time.

The key to this insight lies in the underlying dynamics of the global law firm market, which, although quirky in many ways, is, in economic-theory terms, a reasonably frictionless or ‘pure’ market (lots of competitors with relatively low market share, low barriers to entry/exit, similar products and excellent price visibility).

In other sectors, profits can be heavily influenced by ownership of critical IP (pharma), regulations and licences that thwart competition (telecoms), assets that bar entry (energy), effective monopolies or oligopolies (big tech), etc., none of which applies in any significant way in the premium legal market.

Firms only succeed commercially if they compete effectively year in and year out for what they earn. And because the purchase cycle is relatively short, clients can react quickly to any perceived changes in the relative competitiveness of any one firm.

Being a relatively ‘pure’ market, individual firms (and their partners) compete based on three components: reputation (what those who’ve experienced you think about your service), relevance (what problems you’re perceived to be best at solving and where geographically you solve them) and visibility (how well known you’re known to the clients around the world who have those problems – and the budgets to pay for your services).

These three components combined comprise a firm’s ‘brand’ – the combined brand equity of the firm and its partners – arguably the only source of sustainable competitive advantage that a law firm has.

It’s important to note that being a ‘stronger’ and more valuable brand overall does not necessarily imply being a ‘better’ brand for every occasion.

For instance, the Mercedes brand is regularly measured to be ten times as valuable as the Ferrari brand ($50bn vs $6bn), but that doesn’t mean that Ferrari isn’t a strong brand in its niche. It’s just not as valuable overall because, relative to Mercedes, its niche is tiny.

UK-headquartered firms will be included in our Global Elite Brand Index, publishing in September.

If you enjoyed this article please like and share with others. If you want to recieve more like this from Principia you can subscribe here (bottom of page).