Generic to genius: strong PSF brands are 2-300% more profitable

Professional service firms with strong brands are 2-300% more profitable than firms with similar capabilities, serving similar clients from similar locations but with vanilla brands.

In the professional services sector, the idea that strong brands are more profitable than weak brands isn’t exactly an earth-shattering statement.

But how much more profitable, and what can those firms with relatively weaker brands do to move some of the brand profit premium onto their side of the table?

The answer lies in adopting a brand-led focus to strategy, which involves aligning all aspects of the business, from marketing to operations, with the brand’s values and promises.

First among equals

In many sectors, competing businesses produce products and services that are almost identical in all measurable ways that customers say they value.

Whether in smartphones, retail banking, or automobiles, it’s hard to distinguish competing products and services based on their’ specs’.

The only things that distinguish these more or less identical products and services in customers’ eyes are their brands: the set of ideas, promises, and expectations that exist in the customers’ minds that complement the core functionality of the products and services.

The brand I’m talking about here is the sum total of the perceptions about a brand’s product or service held by consumers in the market.

Brand ≠ logo

To be clear, these differences have little or nothing to do with logos. Brands have logos, but brands aren’t logos. The brand I’m talking about here is the sum total of the perceptions about a brand’s product or service in the minds of consumers in the market.

In the case of professional services, this includes the perceptions that exist in the minds of your current and potential clients (and their wider stakeholders), your firm’s internal ‘belief’, and even peer-group kudos.

Brand = $$$

Easy access to performance data for publicly traded companies has led to several annual surveys that attempt to measure the dollar value of these brands.

It’s possible to argue about the methodology of one survey vs. another, but the overall pattern is clear: brands are recognised as incredibly valuable assets these days, even by accountants!

Apple’s brand, usually measured as the world’s most valuable, is said to be worth about $502bn at the last count.

Private – keep out!

That’s great for the consumer products sector, but what about professional services?

Some of the published surveys include a few examples of professional service firms. However, they are limited to only including the largest, publicly traded companies, so they don’t get very far into the reaches of the ‘professions’ or the vast swathes of consulting and advisory businesses around the world.

Many of these are privately owned, making accessing their global performance data harder or impossible. Because of their lack of liquid market valuation metrics (i.e. stock prices), it’s also hard to put dollar values on these brands as the surveys like to do.

So, what can we do to find evidence to address the WHY question for professional service firms?

They do things differently there

What if we could find a privately owned professional services sector in which accurate performance data were publicly available for every firm on an annual basis?

If such a sector existed, we could use it to analyse brand performance and demonstrate that firms with stronger brands are more profitable than their similar-sized peers, serving similar clients with similar capabilities.

Step forward the global legal industry.

With annual revenues in the region of $950bn, the global legal sector is big enough to serve as a proxy for other professional services sectors in scale and size.

Also, a feature of the legal industry is that whilst the big firms have grown rapidly over recent years, the market hasn’t seen anything like the degree of concentration in adjacent sectors, such as accounting, technology consulting, and management consulting.

As a result, there’s nothing like a Big 4/5/6 in the premium legal market, and even the names at the bottom half of the top 50 are still very well-known firms, with thousands of people doing premium legal work for Fortune 500 companies and financial institutions all around the US and internationally.

Whichever way you cut it, the data is clear.

Total transparency

In 1985, the American Lawyer’s then-editor Steve Brill had the (brilliant?) idea of estimating and publishing performance data for the top law firms.

This survey, known as the AmLaw 100, quickly became an annual ritual recognised and supported by all the largest US-headquartered law firms as they grew and grew in size and international reach.

The inaugural 1987 survey calculated that the top 100 firms generated $7bn in revenues — today, it’s over $100bn.

Today’s AmLaw editors have very little estimating to do because all the firms submit their performance data in an orderly way after the turn of the calendar year, allowing the American Lawyer to publish the AmLaw 100 in the middle of Spring each year.

Miles better

So, what does a close analysis of this ‘petri-dish experiment’ (referring to the AmLaw 100 survey) tell us about the impact of strong brands on profitability?

It provides a clear and compelling case that firms with stronger brands are significantly more profitable than their peers.

Whichever way you cut it, the data is clear.

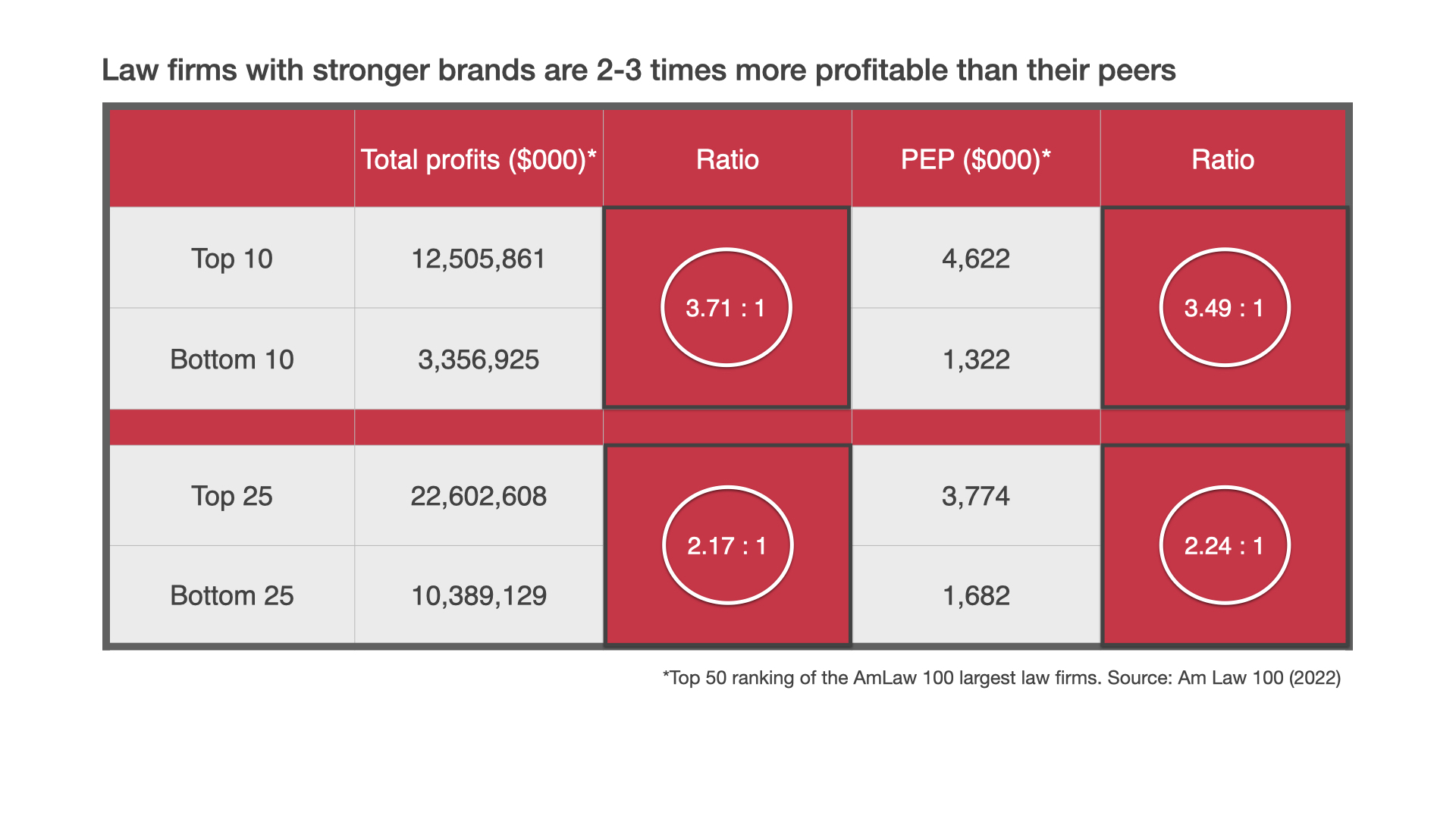

The AmLaw firms with the strongest brands are 2-300% times more profitable than their peers — similar-sized firms with similar capabilities, serving similar clients from similar locations.

The difference in profitability is 300% when you compare the top 10 firms to the bottom 10 (of the top 50) and 200% when you compare the top 25 to the bottom 25 (again, of the top 50 firms).

Take your pick of which comparison feels fairest between the strongest and weakest brands among these otherwise very similar institutions.

This stark difference in performance is also consistent whether you measure the overall profitability of these firms or, as some lawyers like to do, compare average PEP (profits per equity partner).

Level playing field

Why is the difference in profitability between one law firm and another a proxy for its brand?

The answer lies in the dynamics of the global law firm market, which is reasonably ‘frictionless’ or ‘pure’.

This means there are lots of competitors with relatively low market share, low barriers to entry/exit, similar products, and reasonable price visibility, all of which contribute to a more competitive and efficient market.

In other sectors, profits can be heavily influenced by ownership of critical IP (pharma), regulations and licences that thwart competition (telecoms), assets that bar entry (energy), effective monopolies or oligopolies (big tech), etc. None of this applies in any significant way in the premium legal market.

Law firms only succeed commercially over time if they compete effectively year in and year out. Because the purchase cycle is relatively short, clients can react quickly to any perceived changes in the relative competitiveness of any one firm (evidenced by the rapid decline and fall of a number of firms over the years).

Being a relatively pure market, individual law firms compete based on three components: reputation (how good their service is perceived to be by those who have experienced it), relevance (what problems they’re perceived to be best at solving), and visibility (how well known they’re known to clients who have those problems—and the budgets to pay for their services).

These three components, added together, comprise a firm’s ‘brand’—arguably the only source of sustainable competitive advantage for law firms and most other professional service firms.

This is the critical step to applying this analysis to the broader professional services sector. Unless your part of the professional services market has significant IP ownership, monopoly powers, regulatory protection or other barriers to competition, there’s every reason to believe that the 2-300% profit premium applies.

Suppose your firm has a vanilla brand compared to your strongest competitors. In that case, the good news is that you’ve got a lot of profit headroom to grow into if you can get your arms around your brand and take the strategic steps needed to move from vanilla towards premium (chocolate?).

Adopting a brand-led focus to strategy – a strong focus on drivers of reputation, relevance and visibility – is a powerful way to significantly and sustainably improve profitability.

Takeaways

Just as the brand valuation data shows for publicly traded companies, this analysis shows that professional service firms with the strongest brands in their sector are 2-300% times more profitable than their peers with vanilla brands, all else being equal in terms of size, capabilities, clients, and locations.

The insight for leaders of professional service firms is that adopting a brand-led focus to their strategy – a strong focus on drivers of reputation, relevance, and visibility – is a powerful way to significantly and sustainably improve their profitability.

If you enjoyed this article please like and share with others. If you want to recieve more like this from Principia you can subscribe here (bottom of page).